As the U.S. markets experience a tech-led rally with the S&P 500 and Nasdaq Composite posting gains, investors are keenly observing growth companies that combine robust potential with strong insider ownership. In this dynamic environment, identifying stocks where insiders hold significant stakes can be indicative of confidence in the company’s future prospects, aligning well with current market enthusiasm for innovation-driven sectors.

Name | Insider Ownership | Earnings Growth

———|———————-|——————-

- Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7%

- Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3%

- Clene (NasdaqCM:CLNN) | 21.6% | 59.1%

- eHang Holdings (NasdaqGM:EH) | 31.4% | 79.6%

- BBB Foods (NYSE:TBBB) | 22.9% | 40.7%

- Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3%

- Credit Acceptance (NasdaqGS:CACC) | 14.1% | 49%

- Capital Bancorp (NasdaqGS:CBNK) | 31.1% | 30.1%

- Corcept Therapeutics (NasdaqCM:CORT) | 11.6% | 34.7%

- Ryan Specialty Holdings (NYSE:RYAN) | 16.8% | 36.4%

Click here to see the full list of 198 stocks from our Fast Growing US Companies With High Insider Ownership screener

Let’s dive into some prime choices out of the screener.

Roku

Overview

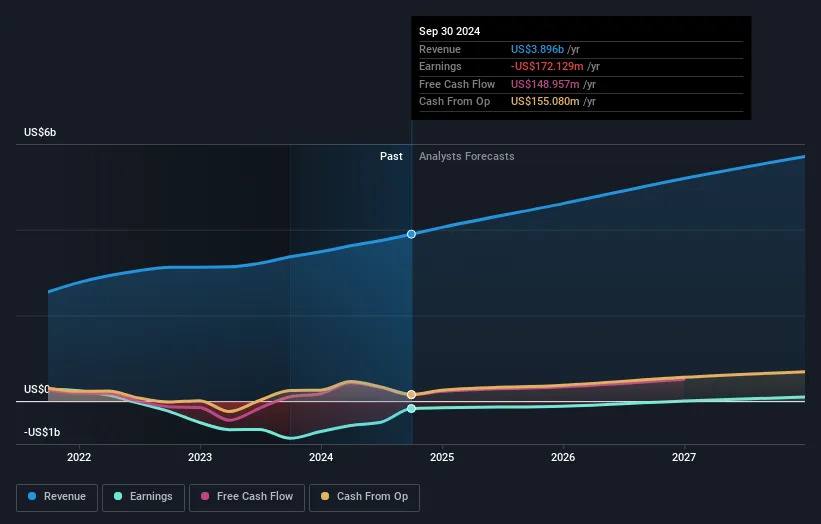

Roku, Inc., along with its subsidiaries, operates a TV streaming platform both in the United States and internationally, with a market cap of approximately $11.24 billion.

Operations

The company’s revenue is primarily generated through its Platform segment, which accounts for $3.32 billion, and its Devices segment, contributing $579.97 million.

Insider Ownership

12.3%

Roku’s growth prospects are underscored by its forecasted revenue increase of 10.8% per year, surpassing the US market average, and anticipated profitability within three years. Recent product launches, such as the QLED TVs and Roku Streaming Stick+, demonstrate the company’s commitment to innovation.

Sea

Overview

Sea Limited, also known as Sea Group, is a Singapore-based multinational e-commerce company with a diverse portfolio of digital businesses. Its market cap stands at approximately $80 billion.

Operations

The company operates three main platforms: Shopee, Garena, and SeaMoney. Shopee is one of the leading e-commerce platforms in Southeast Asia, while Garena is a popular online gaming platform. SeaMoney provides financial services to consumers and merchants alike.

Insider Ownership

Sea’s growth prospects are fueled by its strong revenue growth, with a forecasted increase of 30% per year over the next three years. The company’s commitment to innovation, coupled with its expanding presence in emerging markets, positions it for long-term success.

Turning Ideas Into Actions

Dive into all 198 of the Fast Growing US Companies With High Insider Ownership we have identified here. Are any of these part of your asset mix?

Tap into the analytical power of Simply Wall St’s portfolio to get a 360-degree view on how they’re shaping up.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven’t yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:ROKU, NasdaqGS:ULCC, and NYSE:SE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

View Comments