Nvidia’s Record-Breaking Performance: What to Expect After CES 2025

Key Takeaways

Shares in AI favorite Nvidia will remain in the spotlight on Tuesday after CEO Jensen Huang provided several important technology updates last night during his keynote address at the CES 2025 conference in Las Vegas. The stock broke out above the top trendline of a descending channel on Friday, with bullish momentum continuing into Monday’s trading session ahead of Huang’s address. The stock hit a record closing high on Monday and is gaining ground in premarket trading today.

Investor Attention Focused on Key Overhead Areas

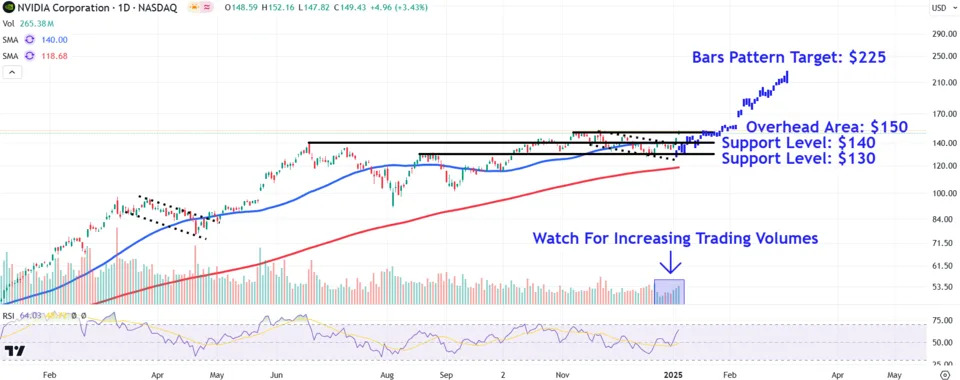

Investors should watch key overhead areas on Nvidia’s chart around $150 and $225, while also monitoring major support levels near $140 and $130. These areas will be crucial in determining the stock’s future performance in light of Huang’s CES update.

Nvidia’s Record-Breaking Performance: A Closer Look

Shares in artificial Intelligence (AI) favorite Nvidia (NVDA) will remain in the spotlight on Tuesday after CEO Jensen Huang provided several important technology updates last night during his keynote address at the CES 2025 conference in Las Vegas. During the highly anticipated event, Huang unveiled next-generation AI-powered gaming chips, introduced technology that speeds up the training of robots, launched the chipmaker’s first desktop computer and announced a deal with Japanese automaker, Toyota (TM).

Nvidia is coming off another banner year during which insatiable demand for AI infrastructure helped drive its stock price up about 170%. Those gains followed a more than three-fold increase in 2023. Nvidia shares, which hit a record closing high of $149.43 on Monday, were up another 2.5% in recent premarket trading and poised to hit an all-time intraday high today.

Descenging Channel Breakout and Trading Volumes

Nvidia shares broke out above the top trendline of a descending channel on Friday, with bullish momentum continuing into Monday’s trading session ahead of Huang’s presentation. While the stock set a record closing high yesterday, the price closed significantly below its intraday peak to form a shooting star, a candlestick pattern that can signal a potential reversal.

Looking ahead, investors should watch for increasing trading volume, which would signal conviction behind recent buying. Although share turnover registered its highest level in more than a week on Monday, it remains below longer-term averages, suggesting that larger market participants remain on the sidelines.

Key Overhead Areas to Watch

The first immediate overhead area to watch sits around $150. While the price has traded above this key level on multiple occasions since early November, it has failed to decisively close above it.

Potential Price Target Above All-Time High (ATH)

To project a potential price target above the stock’s all-time high (ATH), we can use the bars pattern tool. This works by extracting the uptrend from April to June last year and repositioning it from last month’s low. Such analysis forecasts a target of around $225, about 50% above Monday’s closing price.

Major Support Levels

During pullbacks, investors should initially watch the $140 level. Those who prefer not to chase breakouts may look for entry points in this area near the descending channel’s top trendline, which also closely aligns with the stock’s prominent June peak.

Finally, the bulls’ inability to defend this area could see Nvidia shares retrace to around $130, a location on the chart where the price may find support near the August swing high and December swing low.

Conclusion

As investors react to Huang’s CES update, it is essential to monitor key overhead areas and major support levels. The stock’s performance in the coming days will be crucial in determining its future trajectory. With a record-breaking performance already under its belt, Nvidia’s shares are poised for further growth.